Receive Payments Online with these Fastest & Secured Methods

Have you concluded with your client on a particular way to receive your payment on an agreed business transaction…

Have you concluded with your client on a particular way to receive your payment on an agreed business transaction and you do not know The Best Way To Receive Payments Online, then this write up is for you. All you need to do is read carefully below and select the best way you can do you payment without any charges.

The Best Way To Receive Payments Online

Many banks have begun to offer free money transfer services. Most of these services require both people to have an account with that bank. Bank of America, for example, enables this service through its online account management or a downloadable smartphone app. Chase bank has QuickPay, a service which operates similarly to PayPal and enables you to receive money from anyone via mobile number or email address, even if you’re not a Chase Bank account holder.

Things You Must Consider When Choosing a Payment Processor

- Transaction fees: how much it charges for each transaction

- Processing time: how much time it needs to process payments

- Country availability: can you receive payments in your country

- Currency support: can you receive payments in your currency

- Payment methods: does it support your preferred freelance payment methods

- Transfer limit: how much money can you receive at once

Below are the best popular payment processors: PayPal • Payoneer • Cash app • Quickbooks Online • Google Pay • Skrill (Moneybookers) • Venmo • Dwolla • Authorize.net • Xero • TransferWise • Stripe • Escrow • Western Union • Moneygram • Xoom

- PayPal

PayPal is an online payment system with over 270 million users – you create an account on the PayPal website, connect your credit card and then the client can pay you via his/her own account before you withdraw the money from your PayPal balance.

PayPal payment processing time: 3-5 business days

PayPal fees:

- $0.30 for each US transaction + 2.9% of the amount you receive from the US

- 4.4% for each non-US transaction + fixed fee percentage depending on the country

Country availability: Available in over 200 countries. However, not all countries can receive payments (only send them), so check the eligibility of your country here before opening a PayPal account.

Currencies: Available in 26 currencies

Payment methods: Bank transfer, PayPal Debit Mastercard, Requesting a check

Transfer limit: up to $10,000 per transaction

Notable features:

- Barcode scanner

- Online invoicing

- Virtual Terminal

2. Payoneer

Payoneer is one of the more popular PayPal alternatives – essentially, users can receive and make online payments in a couple of clicks, as well as track their account balance and entire transaction history. This tool is also one of the best answers to the question of how to receive payments online for free.

Payoneer payment processing time: 3-5 business days

Payoneer fees:

- $2.99 for local bank transfer, or $15 for USD SWIFT transfer

- $4 or 1% of the amount you receive for USD and EUR transfers (fees cannot exceed $10)

Country availability: accepted payment method in 200+ countries.

Currencies: available in 150+ currencies

Payment methods: Bank Transfer, MasterCard, local eWallets, international checks

Transfer limit: Payoneer cardholders can withdraw up to $5000 per day (up to 20 separate ATM withdrawals per day)

Notable features:

- Single and mass payout

- Integrated payments

- No regular bank account needed – you get a virtual account in a US bank

3. Cash app

Cash app (also known as Square Cash, and Square Cash App) is a mobile payment platform that enables users to transfer money by using their mobile phones alone.

Cash app payment processing time: immediate transfer, or 1-3 business days

Cash app fees:

- No fee, for standard 1-3 business days deposits

- 1%, if you use the immediate “Cash out” transfer option

Country availability: US (but not US territories such as American Samoa, Puerto Rico, and Guam), Japan, Canada, Australia, and the United Kingdom. All accounts are country-bound – you cannot create a Japanese account unless you live in Japan, and you cannot accept payment from Japanese accounts if you don’t have a Japanese account yourself.

Currencies: The country of your account determines your currency, and cannot be altered (for a new currency, you’ll need to open a new account).

Payment methods: Debit Visa card (also known as the Cash Card), Bank Transfer

Transfer limit:

- Unverified accounts can send up to $250 and receive up to $1,000 per week

- Verified accounts can send up to $2,500, and there is no limit to how much you can receive

Notable features:

- Bitcoin trading

- Sending money using Siri (on iPhone)

- An advanced fraud detection infrastructure

4. Quickbooks Online

QuickBooks is essentially an accounting software, but there’s also an easy answer to the question of how to receive payments in QuickBooks online – you send out an invoice, schedule recurring payments, accept them, and then record all made payments to the software.

QuickBooks payment processing time: 1-7 business days

QuickBooks fees:

The monthly payment plan costs $16 per month + transaction fees of $1.00 per ACH transfer, but there’s also:

- 1.5% + $0.25 per swiped card transaction

- 2.9% + $0.25 per digital invoice card transaction

- 3.4% + $0.25 per keyed-in card transaction

Country availability: Available globally. For a full list of countries check out this list.

Currencies: available in 150+ currencies

Payment methods: Credit Card, Debit Card, ACH Bank Transfer

Transfer limit: depends on your processing volume (the amount of money transferred within your account in the last 30 days)

Notable features:

- Online invoicing

- Scheduled recurring payments

- Invite your accountant to partake in your transactions

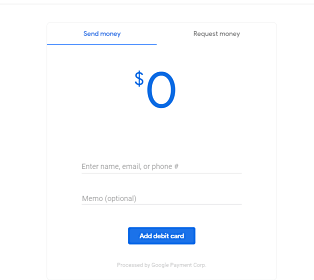

5. Google Pay

Google Pay (combines and replaces the previously used Android Pay, Google Pay Send and Google Wallet) allows you to send and receive payments for free, from your mobile or desktop device – your clients just need to enter your email address or phone number to send you the money. Once you create an account, you get a PIN number you’ll use to manage all transactions.

Google Pay payment processing time: up to 10 business days

Google Pay fees:

- No fee for Debit Cards and Bank transfers

- A 2.9% fee for Credit cards

Country availability: available in 30+ countries overall, but also available on watches that support Google Pay for the United States, Australia, Canada, France, Germany, Italy, Poland, Russia, Spain, and the United Kingdom.

Currencies: available in 10+ currencies

Payment methods: Debit card, Credit Card, Bank transfer, PayPal (in the US and Germany)

Transfer limit:

- Up to $9,999 per transaction (or up to $3,000 for Florida residents every 24 hours)

- In order to claim transactions that are over $2,500, you’ll need to have a bank account connected to your Google Pay account

Notable features:

- Integration with other Google services

- Analytics for traffic, affinity, and engagement related to your brand

- Claim your money through SMS, by requesting a link

6. Skrill (Moneybookers)

Skrill is an online payment processor that allows you to make international money transfers at a low cost.

Skrill payment processing time: up to 3 days for the Skrill review team to approve the transfer, and up to 24 hours to have the payment transferred to your account.

Skrill fees:

- 9% of the sent amount (no more than €20 or the equivalent currency) + a currency conversion fee of 3.99% for Skrill’s exchange rate

Country availability: Skrill is globally available, except for a smaller number of countries you can find in this list.

Currencies: available in 15+ currencies

Payment methods: Bank transfer, Credit card, Debit card, digital eWallet

Transfer limit: Between $135 and $25,000 per month, depending on whether your account is verified or not.

Notable features:

- Email transactions

- Improved fraud management

- 20 local payment methods + 80 direct bank connections

7. Western Union

Western Union is a money transfer company that offers online payment and on-site payouts on over 500,000 worldwide locations.

Western Union payment processing time: usually between 2-5 business days

Western Union fees:

Depend on the countries involved, the transaction amount, and the payment method used, for example:

- Domestic transfer where the sender sends cash and the receiver collects cash, the transaction fee is $5

- If you handle the transaction through an online bank account, the transaction fee is $11

- If you handle the transaction through a debit or credit card, the transaction fee is up to $49.99

Country availability: available in 200+ countries

Currencies: available in 140+ currencies

Payment methods: Cash pickup, Bank transfer, Credit card, Debit card, the Western Union website, over the phone, in person

Transfer limit:

Depends on your transaction history, and whether you’re making a domestic or international transfer:

- Within the In minutes or Three days option transfer – the limit is $2,999 per transfer

- Next day payment option – the limit is $500 per transfer

- Payments carried out at agent location – there no limit

- Payments organized via phone – the limit is between $300 – $2,500

Notable features:

- Backup for recipients who haven’t disclosed their ID

- Advanced encryption technology

- Special ways for students and the military to receive payments

8. Moneygram

Moneygram is another money transfer company that offers both domestic and international transfer – it’s mostly geared towards international transactions with over 360,000 on-site agent locations (over 25,000 in Africa alone).

Moneygram payment processing time: up to 24 hours

Moneygram fees:

Depend on the countries involved, the transaction amount, and the payment method – bank transfer requires lower fees, and a credit card or debit card require higher fees.

For example:

- Online bank transactions cost $11.00

- Debit card transactions cost $49.99 for amounts between $50 and $900

- Debit card transactions require a 2% fee for amounts over $900

Country availability: Available in 200+ countries

Currencies: Available in over 45+ currencies

Payment methods: Cash pickup, Bank Transfer, Mobile Wallet account, Debit card, Home Delivery

Transfer limit:

- up to $899.99 per transaction

- up to $3,000 in a span of 30 days

Notable features:

- Track the money transfer from send off to delivery

- No need for an official bank account

- Payments carried out online or through agent locations

We hope this information was useful, then use the comment box below.